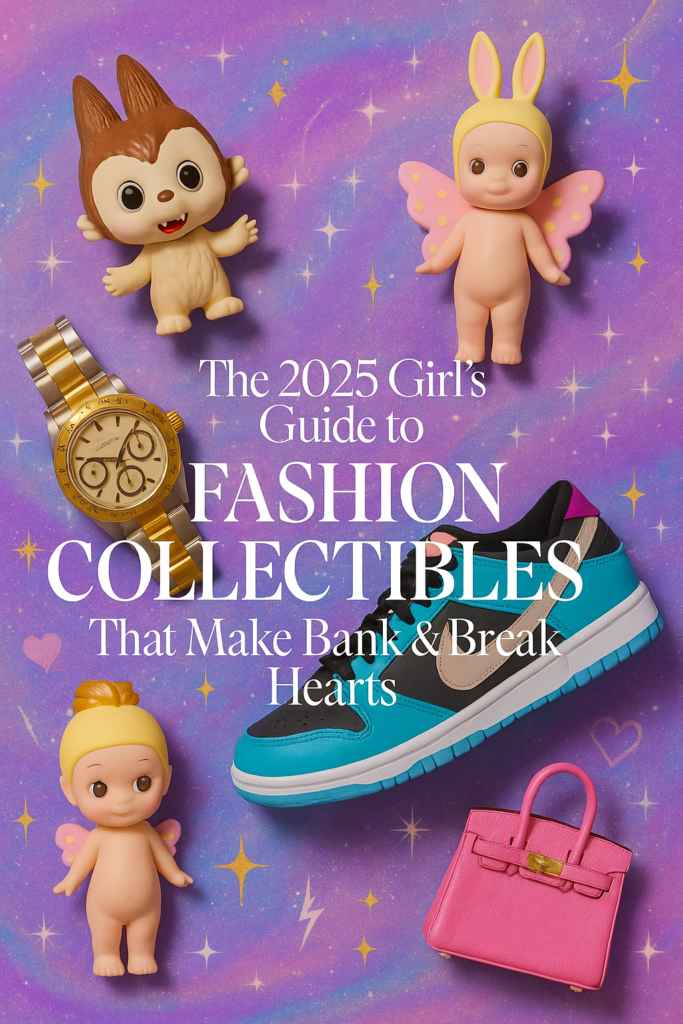

The Final 2025 Information to Worthwhile Vogue Collectibles

What in case your style obsession may repay massive time? Whether or not you’re eyeing uncommon sneakers, classic Rolexes, or kawaii artwork toys, style collectibles have gotten the most well liked funding of 2025, with the worldwide market on monitor to hit $500 billion. We dove right into a recent examine by Kaia analyzing every part from Labubu toys to Hermès baggage, revealing what’s hovering in worth—and why.

So, seize your oat matcha and let’s unpack probably the most worthwhile style collectibles of 2025, why they’re skyrocketing, and how one can begin investing at present.

📊 The 2025 Worthwhile Vogue Collectibles Listing (Ranked & Analyzed)

1️⃣ Labubu (Pop Mart Artwork-Toy): The Kawaii Queen of Returns

- Retail: $20 → Resale: $380 → 19x return

- Key perception: Labubu tops the charts due to excellent cultural momentum (10/10)—pushed by TikTok unboxings and Pop Mart’s unstoppable world enlargement. It additionally scores 8.7/10 for accessibility, making it simple for brand spanking new collectors to begin.

2️⃣ Sonny Angel (Restricted Ed.): The Sneaky Excessive Curler

- Retail: $10 → Resale: $2,599 → 260x return

- Key perception: These Japanese collectible figurines crush the charts with the best particular person resale multiplier outdoors luxurious watches. Robust liquidity (8/10) and cult enchantment throughout Asia and Instagram gas explosive costs.

3️⃣ Nike SB Dunk Low (2005): Sneaker Grail with Legacy Energy

- Retail: $65 → Resale: $13,000 → 200x return

- Key perception: This golden period of skate tradition has turn into a cornerstone of sneaker investing. Regardless of larger entry prices than artwork toys, Dunks from this period put up large ROI and keep strong liquidity (7/10).

4️⃣ Rolex Daytona (ref. 6239, late Nineteen Sixties): The Timeless Titan

- Retail: $200 → Resale: $225,000 → 1125x return

- Key perception: The Rolex Daytona demonstrates luxurious’s endurance. Regardless of scoring lowest on cultural momentum (3/10) in comparison with streetwear, its heritage makes it absolutely the king in greenback worth development.

5️⃣ Nike SB Dunk Low (2002): The Underrated Heavy Hitter

- Retail: $60 → Resale: $7,000 → 117x return

- Key perception: Early Dunks are massively undervalued by new collectors, with excessive accessibility (8.22/10) and liquidity (6/10) displaying the potential for regular flips.

6️⃣ Off-White x Air Jordan 1 (2017): Hype Meets Icon

- Retail: $190 → Resale: $6,000 → 31.6x return

- Key perception: Virgil Abloh’s legacy stays sturdy. This sneaker balances hype and design heritage, with steady liquidity (7/10) making it a dependable funding.

7️⃣ Air Jordan 1 (OG 1985): The Legend That Began It All

- Retail: $65 → Resale: $2,500 → 38.5x return

- Key perception: Practically 40 years later, the OG Jordans are nonetheless rising, proving nostalgia-fueled demand won’t ever die.

8️⃣ Supreme x Louis Vuitton Field Emblem Hoodie (2017): The Streetwear Unicorn

- Retail: $860 → Resale: $25,000 → 29.1x return

- Key perception: This collab solidified Supreme’s shift from skatewear to luxurious. Regardless of a excessive buy-in, it combines sturdy cultural momentum (6/10) with fashion-world credibility.

9️⃣ KAWS 4-ft Companion (2011): The Artwork Market’s Darkish Horse

- Retail: $5,000 → Resale: $130,000 → 26x return

- Key perception: KAWS’ sculptures have gone from area of interest road artwork to severe up to date artwork, mixing style with gallery-level worth. It’s a reminder of artwork toys’ energy in collectible markets.

🔟 Nike Air Yeezy 2 (2014): The Kanye Impact

- Retail: $245 → Resale: $5,000 → 20.4x return

- Key perception: The Yeezy line helped redefine the sneaker market. Whereas later Yeezys flooded cabinets, this OG collab with Nike retains premium resale attributable to shortage.

11️⃣ Hermès Kelly Bag (2000): Luxurious’s Sluggish-Burn Darling

- Retail: $2,500 → Resale: $50,000 → 20x return

- Key perception: In contrast to sneakers, Hermès baggage don’t double in a single day—however they climb reliably. The Kelly bag’s exclusivity and timeless design make it a basic for affected person buyers.

12️⃣ Patek Philippe Nautilus 5711 (2021): The Extremely-Luxurious Play

- Retail: $52,000 → Resale: $105,000 → 2x return

- Key perception: Whereas absolute income will be massive, the accessibility rating is lowest (5.28/10) because of the excessive entry value, proving conventional luxurious nonetheless requires severe capital.

13️⃣ Hermès Birkin 25 (Croc): The Remaining Boss of Vogue Collectibles

- Retail: $100,000 → Resale: $200,000 → 2x return

- Key perception: The Birkin’s worth doubles however underperforms relative to sneakers and toys. It’s an influence transfer for the ultra-wealthy, however much less environment friendly for return-focused buyers.

🔎 Why Are Sneakers and Artwork Toys Crushing Luxurious?

Kaia’s examine reveals trendy collectibles like artwork toys and sneakers outperform conventional luxurious as a result of they:

✅ Have stronger cultural momentum via TikTok/IG virality

✅ Are extra accessible to youthful collectors

✅ Supply larger liquidity—simpler to flip shortly

✅ Have decrease entry prices, making them interesting for Gen Z/Millennial buyers

In the meantime, gadgets like Rolexes and Hermès baggage depend on heritage, however can’t compete with the quick hype cycles of road tradition.

Why do artwork toys like Labubu and Sonny Angel have such excessive returns?

They’re inexpensive, restricted in manufacturing, and feed into viral unboxing tendencies on TikTok and Instagram—creating an ideal storm of demand.

Are sneakers higher investments than luxurious baggage?

For many younger collectors, sure—sneakers like Nike SB Dunks supply decrease buy-ins and quicker resale in comparison with luxurious purses that take years to understand.

What’s cultural momentum, and why does it matter?

Cultural momentum measures an merchandise’s relevance in present tendencies, popular culture, and social media. The upper it’s, the extra doubtless costs will spike shortly.

Do I want hundreds to spend money on collectibles?

No! Artwork toys like Sonny Angel begin at $10 retail. Even sneakers within the $60–$200 vary can obtain large ROI.

The place can I purchase worthwhile collectibles?

Platforms like StockX, Sotheby’s, Grailed, Pop Mart official websites, and trusted resellers are finest. For classic watches, persist with established public sale homes.

How liquid are these things—can I promote quick?

Liquidity varies: sneakers and artwork toys have excessive liquidity (usually offered in days/weeks), whereas luxurious baggage/watches could take longer.

What collectibles have the best cultural momentum?

Kaia’s knowledge reveals Labubu (10/10), Sonny Angel (9/10), and Nike SB Dunk Low (2005) (7/10) lead in momentum.

What’s the only most worthwhile collectible within the report?

The Rolex Daytona from the Nineteen Sixties had the best resale return: $200 → $225,000, an insane 1125x multiplier.

Are luxurious watches nonetheless a superb funding?

Sure—Rolex and Patek Philippe items present sturdy absolute good points, however require a lot larger preliminary funding.

📝 Remaining Ideas: Ought to You Dive In?

The way forward for style investing is brighter than ever. Sneakers and artwork toys supply decrease obstacles and explosive returns, whereas heritage luxurious maintains regular worth for the affected person investor. Whether or not you need to flex a Birkin or flip a Sonny Angel, there’s by no means been a greater time to show your wardrobe right into a money-making machine.

Trends in Designer Eyeglasses and Eyewear

Tips for Maintaining Your Favorite Designer Pieces

Top Designer Gown Trends to Watch in 2025

The Rise of Quiet Luxury: Subtle Designer Looks That Speak Volumes

The Allure of Designer Shades: Exploring the World of Prada Sunglasses