Many duos throughout the meals and beverage trade are merely iconic ― milk and cookies, peanut butter and jelly, espresso and doughnuts. Different notable duos, like Jack Daniels and Coca-Cola, now come within the type of their very own ready-to-drink (RTD) cocktail.

Extra just lately, Malibu partnered with Dole to introduce Malibu & Dole RTD Cocktails. The cocktails, that are impressed by the favored pairing of Malibu and Dole pineapple juice, are set to launch early 2026 and one other instance of an iconic beverage duo in an RTD format.

The brand new line will embrace a spread eight-pack of 12-ounce cans with 4 flavors: Pineapple, Pineapple Mango, Pineapple Strawberry, and Pineapple Dragon Fruit. Massive format single 19.2-ounce cans can be accessible in Pineapple and Pineapple Mango.

“Malibu & Dole have had a long-standing relationship and have been loved collectively by our shoppers in bars and houses throughout the nation for a few years,” mentioned Natalie Accari, division vice chairman and basic supervisor of RTD and comfort at Pernod Ricard USA, in a press release. “This innovation takes our shoppers favourite serve and makes it much more accessible in a handy format.”

In a press release, Elisabeth Morris, director of brand name licensing at Dole Meals Co., mentioned the model is thrilled to embark on the brand new collaboration with Malibu.

“Each manufacturers are leaders of their class and bringing them collectively in a extremely fascinating and handy format will solely improve the buyer expertise year-round,” Morris mentioned.

Previous to Malibu and Dole’s information, the beverage market has seen model licenses cross strains with non-alcohol merchandise venturing into alcohol. Shopper traits have lent themselves to this motion.

Sydney Riebe, U.S. meals and beverage analyst at Mintel, Chicago, shares her ideas on the subject.

“Shoppers more and more worth comfort, and with many of those improvements displaying up as ready-to-drink choices, that is definitely a driver of this motion,” she says. “Taste and texture innovation can also be prevalent amongst these launches, reflecting youthful shoppers’ curiosity in additional novel, world flavors.”

Moreover, Riebe notes that social media is a robust driver for discovery, model recognition and the flexibility for beverage traits to seek out virality, particularly with limited-time and collaborative merchandise.

Brian Sudano, CEO of S&D Insights, LLC, Norwalk, Conn., states that customers are more and more ingesting much less.

“Non-alcoholic manufacturers deliver with them with credentials as being decrease in or no alcohol,” he says. “This enables for them to be marketed as nice tasting grownup drinks as some extent of entry for youthful shoppers. As well as, shoppers getting into authorized ingesting age are receptive to attempt these trusted manufacturers in an alcohol format as they enter the grownup beverage panorama.”

As profitable non-alcohol manufacturers have already got robust followings, Sudano says getting access to retail cabinets shortly with scale is way simpler than for an unproven new model.

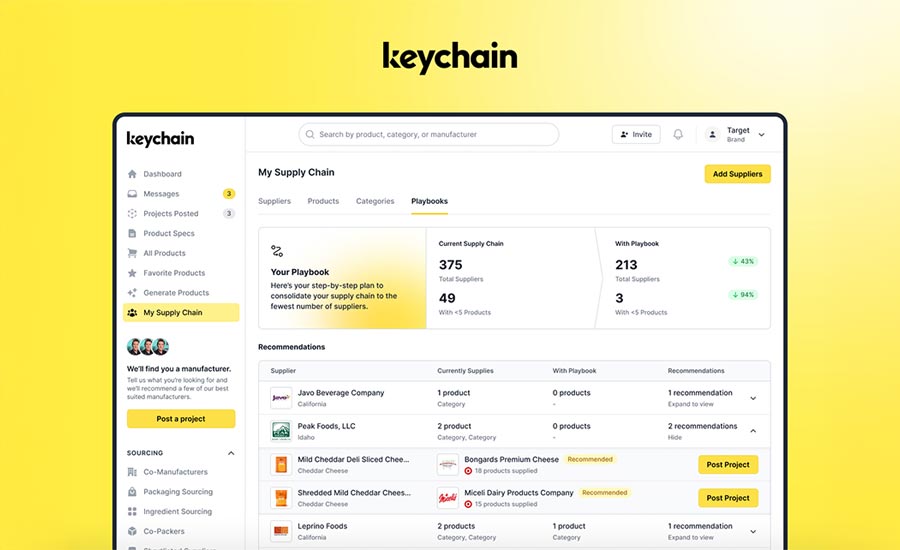

Mitch Madoff, head of retail partnerships at Keychain, New York, says an enormous a part of the shift in crossing strains comes all the way down to nostalgia.

“Individuals love seeing their on a regular basis manufacturers in new codecs, and in at the moment’s atmosphere, that sense of consolation is extra interesting than ever,” he shares. “Recognizing this, manufacturers are tapping into childhood favorites and creating grownup experiences. Take Minute Maid and Sunny D for instance — shoppers who grew up ingesting these family staples at the moment are reaching for his or her grownup twists, like Minute Maid Spiked Vodka Punch or Sunny D Vodka Seltzer.”

Like Mintel’s Riebe, Madoff says social media has performed a job in such improvements as effectively.

“Influencers within the beverage house typically submit evaluations as quickly as new drinks hit the market, sparking buzz and making shoppers desperate to attempt them,” he provides.

Sabrina Godfrey, director of promoting communications at Clearwater, Fla.-based Monin Inc., says shopper traits that emphasize familiarity, discovery and expertise are driving the crossover of non-alcohol manufacturers into the alcohol house.

“At this time’s shoppers are desperate to discover new flavors whereas nonetheless looking for pints of recognition, which makes the entry of soppy drink and sweet manufacturers into alcohol particularly efficient,” she states. “By combining novel codecs with nostalgic, comforting tastes, these merchandise cut back the danger of disappointment and encourage trial since folks already belief the model. Nostalgia performs a robust function right here as effectively, as a result of iconic meals and beverage manufacturers don’t simply ship taste, they evoke reminiscences.”

When these manufacturers reappear in alcohol types, Godfrey explains that they spark emotional connections for adults who grew up with them, creating experiences which might be each enjoyable and shareable.

“This shareability is amplified by social media, the place visually putting, story-driven drinks thrive,” she notes. “As highlighted in Monin’s 2025 ‘Reel World’ pattern, shoppers more and more view drinks as content material, and licensed crossovers present immediate viral attraction by merging the recognizable with the novel.”

On the similar time, Godfrey says that the booming RTD class is fueling progress, as licensed codecs provide a mix of comfort and belief — excellent for shoppers who could not combine cocktails at residence, however are drawn to cans that includes two acquainted model names, she provides.

“Lastly, youthful generations equivalent to Gen Z and millennials are driving demand for approachable, flavor-forward drinks over bitter or high-proof choices,” Godfrey describes. “Licensed merchandise from soda, sweet or juice classes instantly align with these preferences, making alcohol extra accessible and interesting to newer legal-age drinkers.

Additional, specialists share how shoppers have reacted to the blurring of beverage strains.

“Basically, there was optimistic shopper sentiment for the alcoholic merchandise that non-alcoholic manufacturers have launched or collaborated on,” Mintel’s Riebe says. “Nevertheless, practically half of shoppers agree that there are too many forms of RTD alcoholic drinks, the class that NA manufacturers have been most probably to enter, indicating excessive class saturation and competitors.”

S&D’s Sudano states that typically, trial is powerful, however sustainability of quantity is harder.

“The non-alcoholic model establishes expectations, that are laborious to ship in opposition to,” he provides.

Shoppers are responding positively to this pattern, Keychain’s Madoff says, as a result of it hits a “candy spot” between familiarity and novelty.

“Individuals take pleasure in seeing their go-to non-alcoholic drink manufacturers enter the alcohol house as a result of it feels approachable and enjoyable,” he describes. “The Keychain platform helps this, with Arizona Arduous Iced Teas displaying robust progress, reflecting the thrill round these crossover merchandise.”

Madoff additionally has noticed that these launches drive social media buzz and word-of-mouth, which fuels trial and retains the momentum going.

Potential conflicts

As a result of so many non-alcohol names are getting into the alcohol house, issues may come up, specialists observe.

Mintel’s Riebe says there’s a potential concern for confusion on packaging and model recognition, by which shoppers make assumptions concerning the class. Mintel doesn’t have any shopper knowledge that backs this up, she provides.

“From a strategic standpoint, a significant concern can be that customers are typically ingesting much less alcohol, and whereas manufacturers proceed to put money into blurring, it’s attainable that extra manufacturers will observe Spindrift and exit the RTD alcohol class, which has turn out to be more and more crowded lately,” Riebe explains.

S&D’s Sudano lists two main issues, the primary being the potential for manufacturers to draw under-aged drinkers, which may harm a model’s picture and doubtlessly expose it to potential regulatory backlash.

“The second concern is, does it complement the model’s relationship with shoppers and supply a halo again to the father or mother model, or does it create model confusion that may have an effect on the father or mother model relationship with shoppers,” he says.

Keychain’s Madoff notes that it isn’t shocking that historically non-alcohol manufacturers face some backlash when shifting into the alcohol house, particularly round packaging and advertising and marketing.

“Some merchandise have confronted pushback for trying too much like their non-alcoholic variations, elevating issues that youthful shoppers may confuse the 2,” he says. “That mentioned, many of those issues are already being addressed by each manufacturers and regulators. Firms are updating their packaging to make the distinction clear.”

Madoff factors to Monster Power for instance of this. The model didn’t simply launch a spiked model of its vitality drink, he describes, it launched a separate product line known as The Beast Unleashed to keep away from confusion with the unique.

“These challenges are actual, however they’re being managed in a approach that lets the class develop responsibly,” Madoff notes.

Sure non-alcohol classes are mostly lending their licensing to alcohol classes.

“Juice manufacturers are main the cost into the alcoholic beverage trade, with merchandise like Merely Spiked or Sunny D Vodka Seltzer gaining reputation,” Madoff says. “The Keychain platform additionally reveals that soda manufacturers are following behind intently — legacy names like Coca-Cola and Mountain Dew are pairing with spirits corporations to develop RTDs and flavored malt drinks.”

Power drinks are one other class getting into the scene, he provides, leveraging their youthful fan base and ties to social events with merchandise like Monster’s Nasty Beast Arduous Tea.

Mintel’s Riebe says that carbonated mushy drink (CSD) manufacturers are mostly getting into into the alcohol class, seemingly as a consequence of robust model recognition and loyalty, and the flexibility to develop their portfolios in collaboration with alcohol manufacturers. She notes that, in such circumstances, alcohol manufacturers “can do the heavy lifting” on the manufacturing facet and improve recognition even additional.

S&D’s Sudano echoes related sentiments, saying that the most typical class licensing to alcoholic classes are CSDs.

“This is sensible, as carbonated mushy drinks are primarily based on taste experiences, and the manufacturers are licensed for merchandise in both flavored malt drinks or spirit RTDs, that are additionally primarily based on taste,” he says.

Keychain’s Madoff says the corporate is seeing the best uptick in laborious seltzers and RTD drinks.

“These classes are essentially the most welcoming areas for non-alcohol manufacturers tapping into the alcohol sector as a result of they depend on novelty and model fairness to face out,” he shares. “Drinks like Topo Chico Arduous Seltzer present how a well-recognized identify can lower by way of the noise and get folks to attempt one thing new in an already crowded market. RTD cocktails are additionally a pure match, with merchandise like Jack Daniel’s & Coca-Cola assembly shopper demand for comfort and trusted flavors.”

Embracing a blurred future

With so many historically non-alcohol beverage manufacturers crossing into the alcohol house, it appears as if the pattern is right here to remain.

S&D’s Sudano notes Coca-Cola as an indicator of this.

“Coca-Cola has publicly said they’re trying on the alcoholic beverage trade as a sustainable supply of further income and venue to growing publicity to its emblems,” he says. “Because of this, they may seemingly proceed to market new flavors and license manufacturers into the beverage alcohol market. You by no means know when the appropriate model and product will hit a candy spot with shoppers.”

Mintel’s Riebe expects the blurring of beverage strains to proceed, however not essentially on the non-alcohol to alcoholic trajectory.

“Continued shopper curiosity carefully and drinks with advantages like superior hydration, vitality, and performance will seemingly drive blurring between non-alcoholic classes,” she states. “Youthful shoppers particularly are engaged with non-traditional drinks, and the way forward for innovation will definitely take this group into consideration.”

Keychain’s Madoff feels equally.

“Shopper preferences preserve shifting, and that’s what’s driving non-alcoholic manufacturers to faucet into the house,” he says. “As folks proceed to hunt out new experiences and types search for contemporary methods to remain related, we’ll seemingly see the class transfer into extra intentional partnerships which have endurance.”

Madoff expects that the subsequent wave can be about aligning with shopper values. He suspects to see merchandise developed with better-for-you substances and purposeful advantages, particularly as extra folks take a look at out sober-curious way of life and reduce on conventional alcoholic drinks.