American producers are about to be handed a really giant invoice. Wherever this administration’s tariffs finally settle, with imports within the trillions, the tab for tariffs goes to be within the billions. Tariffs is not going to solely influence the underside line of American manufacturing firms, however derivatively, additionally impacting how producers take into consideration their enterprise as an entire.

As beverage producers discover themselves contemplating a wide range of financing alternate options whereas navigating the brand new panorama, a sale leaseback could be among the many most tasty choices.

Good for producers

As if there weren’t good causes already for American producers to have entry to extra capital, the chance of tariffs impacting money flows creates one more reason. All typical sources of capital — time period loans, traces of credit score, bond gross sales — ought to proceed to be thought-about when there’s a pending capital want.

One other supply that’s extremely strategic for producers in right this moment’s political and financial atmosphere, but not fairly a part of the usual capital alternate options playbook, is the sale leaseback. Because the identify implies, the sale leaseback transaction entails promoting company-owned actual property, then leasing it again below a long-term lease.

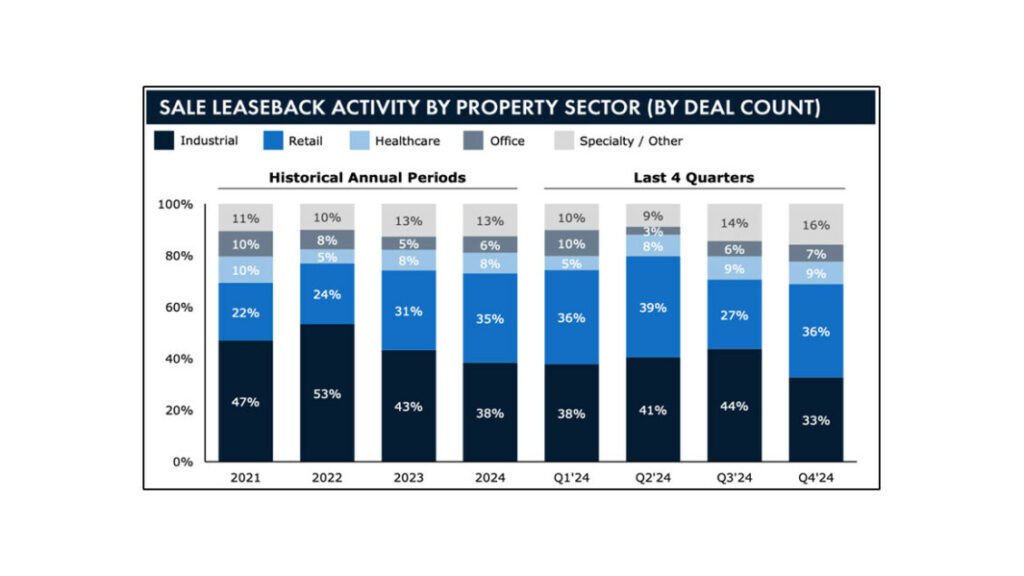

Elevating capital from sale leasebacks is especially apt for producers for 2 causes. First, many producers personal their amenities and second, industrial actual property is in excessive demand amongst buyers in the US. In 2024, industrial transactions made up 38% of all sale leaseback offers.

Making the case

Underlying actual property even in non-core places usually enjoys a premium valuation as in contrast with normal manufacturing firms, which regularly have an enterprise worth based mostly on mid-to-high single-digit EBITDA multiples.

This dynamic permits the sale leaseback to unlock worth sitting quietly on the stability sheet. Consequently, not solely can sale leaseback transactions supply producers a a number of arbitrage however proceeds from a sale leaseback might be utilized for progress, pending tariff funds, or funding acquisitions, amongst a variety of makes use of.

A working example

Sale leasebacks can be utilized by giant and small firms. As well as, they’re agnostic ― no matter what an organization is manufacturing, it could moderately think about a sale leaseback. The next are some latest transactions:

Early this yr, Aztalan Engineering, a contract producer in Lake Mills, Wis., bought and leased again its headquarters. The agency raised $5.1 million within the sale leaseback deal, permitting them to fund acquisitions of different firms.

In December, DBG Arkansas LLC, a producer of metallic merchandise for the automotive, heavy truck and equipment industries, raised $15.7 million in a sale leaseback deal involving its 642,000-square-foot industrial facility in Conway, Ark.

In September, Douglas Dynamics, producer and up-fitter of business work truck attachments and tools, raised $64.2 million promoting amenities in 5 places then leased the properties again from the customer TPG Angelo Gordon. Douglas Dynamics’ Government Vice President and Chief Monetary Officer mentioned the deal will allow the corporate to “Optimize our stability sheet and higher place ourselves for future investments within the enterprise.”

Additionally in September, Incodema3D, a frontrunner in direct metallic 3D printing for aerospace and automotive industries, raised thousands and thousands by promoting its state-of-the-art manufacturing facility in Freeville, N.Y., and leasing it again from purchaser ME Industrial.

In August, Univar Options, a world specialty chemical and ingredient distributor, raised greater than $60 million by way of a sale leaseback transaction with Fortress Web Lease.

Sticking factors

Some C-suite executives are involved about promoting mission-critical actual property belongings. These fears are misplaced and might be allayed by how the sale leaseback settlement with the customer is negotiated. Lease phrases are usually 15-20 years, with choices for one more 20 years or extra. Finally, the vendor can keep efficient management of the property for effectively previous 40 years.

Moreover, sale leaseback buyers are credit score buyers first. A strong monetary profile will drive the optimum final result, since patrons are underwriting the credit score of the tenant.

One other frequent concern for enterprise house owners is {that a} deliberate change of management, i.e., promoting the enterprise in complete or partially, could be impeded by a long-term lease obligation. This can be a respectable concern that may be addressed and efficiently mitigated by way of considerate negotiations of the long-term lease itself within the sale leaseback transaction.

Lastly, many chief executives may balk on the complexity of a sale leaseback transaction and promoting off a key asset, when a plain vanilla mortgage might accomplish the target of elevating capital. Nevertheless, a mortgage permits a borrower to faucet lower than the complete worth of their actual property holding whereas a sale leaseback transaction permits an proprietor to extract full worth.

For instance, a $10 million actual property would illustratively permit a producer to borrow maybe $7-8 million towards it. In contrast, a sale leaseback transaction will allow the producer to entry 100% of the constructing’s worth, or the complete $10 million.

Manufacturing is troublesome. Shifting know-how, discovering and retaining labor, intense competitors, and fickle finish markets all add to the diploma of problem. Add to this record navigating tariffs and managing the fallout of elevating costs to cowl a brand new layer of prices. All sources of capital needs to be thought-about by producers and for the producers that personal their actual property, a nuanced supply of capital, the sale leaseback, is price consideration.