Issues are prompting shoppers to alter their procuring habits, based on a latest survey.

The brand new State of the Shopper survey from Acosta Group affords a nuanced view of right this moment’s shoppers, revealing how they’re navigating financial uncertainty and tariff issues with resilience and adaptableness.

“The most recent findings underscore buyers’ seemingly conflicted opinions concerning issues in regards to the financial system, tariffs, and their very own monetary stability,” mentioned Kathy Risch, senior vp of Shopper Insights and Thought Management at Acosta Group, in a press release. “After the pandemic and 5 years of inflationary issues, buyers have clearly adopted new behaviors. They’ve change into accustomed to slicing again on spending, procuring throughout channels for offers, and splurging, thoughtfully, on these indulgences which can be most significant.”

THE ECONOMY: IT’S COMPLICATED

In line with the brand new research, most shoppers describe the state of the financial system in destructive phrases, with general shopper sentiment declining by 30% by April 2025. There are, nonetheless, latest indications that sentiment may be enhancing.

Knowledge from Acosta Group additionally displays that buyers have gotten much less involved about inflation and are easing up on their discretionary spending cuts. Nonetheless, 60% of buyers say they’re extra apprehensive about rising costs than they had been six months in the past, particularly with regards to meals and grocery prices, which stay essentially the most persistent ache factors.

Tariffs are a supply of concern. Most buyers outline tariffs as taxes on imports, however many are confused about what they imply and their broader influence. Issues are highest for tariffs on meals and drinks (60%), attire (42%), and main items like automobiles (52%), and electronics (51%). Gen Z is essentially the most optimistic, with 45% anticipating constructive outcomes from tariffs over the subsequent three-to-five years. Nevertheless, 62% of shoppers fear that tariffs may result in a recession in 2025, with that concern rising to 70% for millennials.

SHOPPERS ADJUST, FOCUS ON VALUE

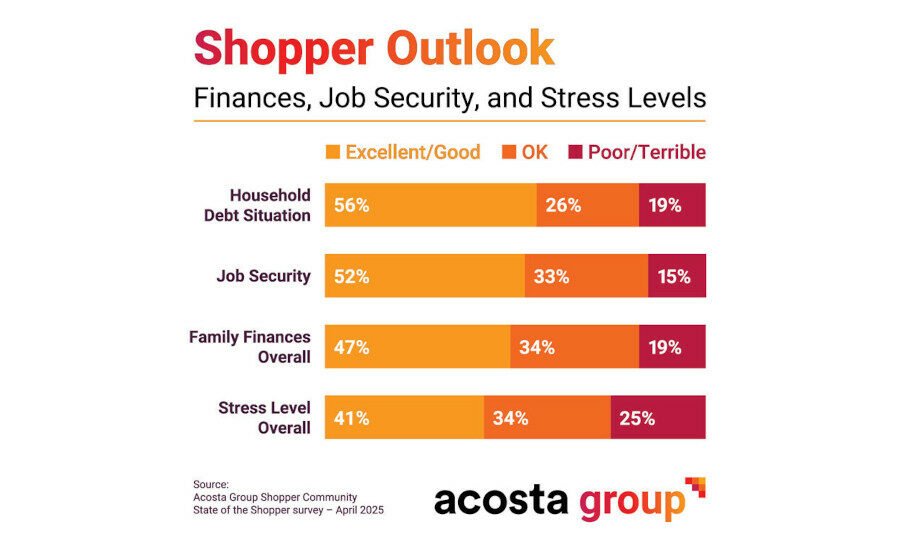

Regardless of general financial uncertainty, comparatively few shoppers categorical a poor outlook for his or her private funds or job safety, although one-third anticipate elevated stress ranges within the coming 12 months.

Households with kids are notably delicate to inflation issues. Amongst shoppers with a extra pessimistic view of their private monetary scenario, a majority have already diminished discretionary spending on objects like eating out (80%), journey (69%), and main purchases (65%).

Most buyers say they haven’t seen any worth reductions prior to now six months. Practically 30% report procuring extra ceaselessly at low cost grocery or greenback shops, and greater than 25% say they’re visiting specialty grocers much less typically because of private monetary constraints. Nonetheless, conventional grocers stay the highest channel of selection at 78%, adopted by mass retailers at 64%, and low cost retailers at 39%.

Though development in non-public label unit share has slowed since mid-2023, practically half of buyers (48%) now say they select retailer manufacturers as a result of they need to, not as a result of they need to. In distinction, solely 16% cite monetary necessity as the primary motive for selecting retailer manufacturers.

SPLURGING AMID CUTBACKS

In its 2025 shopper predictions, Acosta Group said that buyers will crave reasonably priced indulgences away from residence. In line with this new research, shoppers proceed to prioritize indulgences, regardless of cutbacks in discretionary spending.

Eating out, whereas impacted, continues to be the highest splurge for 66% of buyers, confirming that even in difficult occasions, shoppers search satisfying occasions for themselves and their households.

“Manufacturers and retailers should reply by creating alternatives for small, satisfying splurges,” Risch added. “By delivering particular experiences by high quality, uniqueness, and indulgence, manufacturers and retailers can faucet into shoppers’ need for ‘little luxuries.’”

OPPORTUNITIES

Shoppers are adapting to the financial surroundings in a wide range of methods. Forty p.c are shopping for extra retailer manufacturers, boomers are lowering waste and searching for offers, and 43% of Gen Z are merely shopping for much less.

“Within the midst of financial uncertainty and shifting shopper perceptions, manufacturers want to steer with innovation, inform a compelling story, and ship constant worth,” mentioned Chad Barnett, senior vp of Nationwide Consumer Insights at Acosta, in a press release. “For retailers, custom-made choices that spotlight worth and efficient use of digital instruments and platforms is essential. By investing in purpose-driven messaging, sensible shelf methods, and a daring digital presence, manufacturers and retailers can differentiate themselves, reassure shoppers, and win in bodily and digital marketplaces.”

Acosta Group’s “2025 State of the Shopper Survey” was carried out April 25-29, 2025, with 792 adults who’re a part of the corporate’s proprietary Shopper Neighborhood. The Acosta Group Shopper Neighborhood is comprised of greater than 40,000 demographically numerous buyers throughout the U.S. and is the corporate’s proprietary neighborhood for survey engagement.